Company Registration in India - Summary

We provide comprehensive company registration services with the Ministry of Corporate Affairs (MCA), including full support with compliance, government filings, and documentation. Our services cover the preparation of necessary documents (MoA, AoA), expert guidance for smooth registration, and ongoing assistance with annual compliance and regulatory requirements.

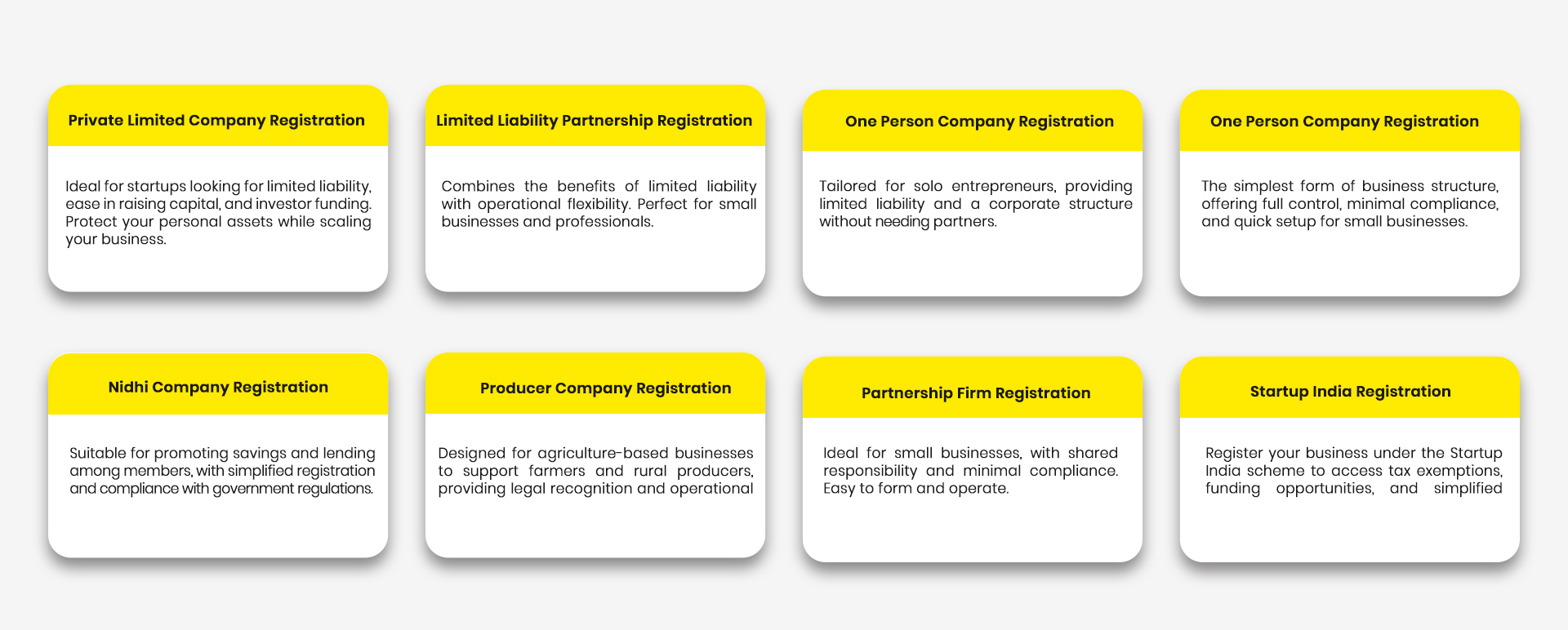

Company Structures in India

Not Sure About Your Business Type?

If you’re unsure about which business structure is best for your venture, don’t worry — you’re not alone!

Our experts will help you navigate all the options and choose the best fit for your needs. Reach out today for a consultation!

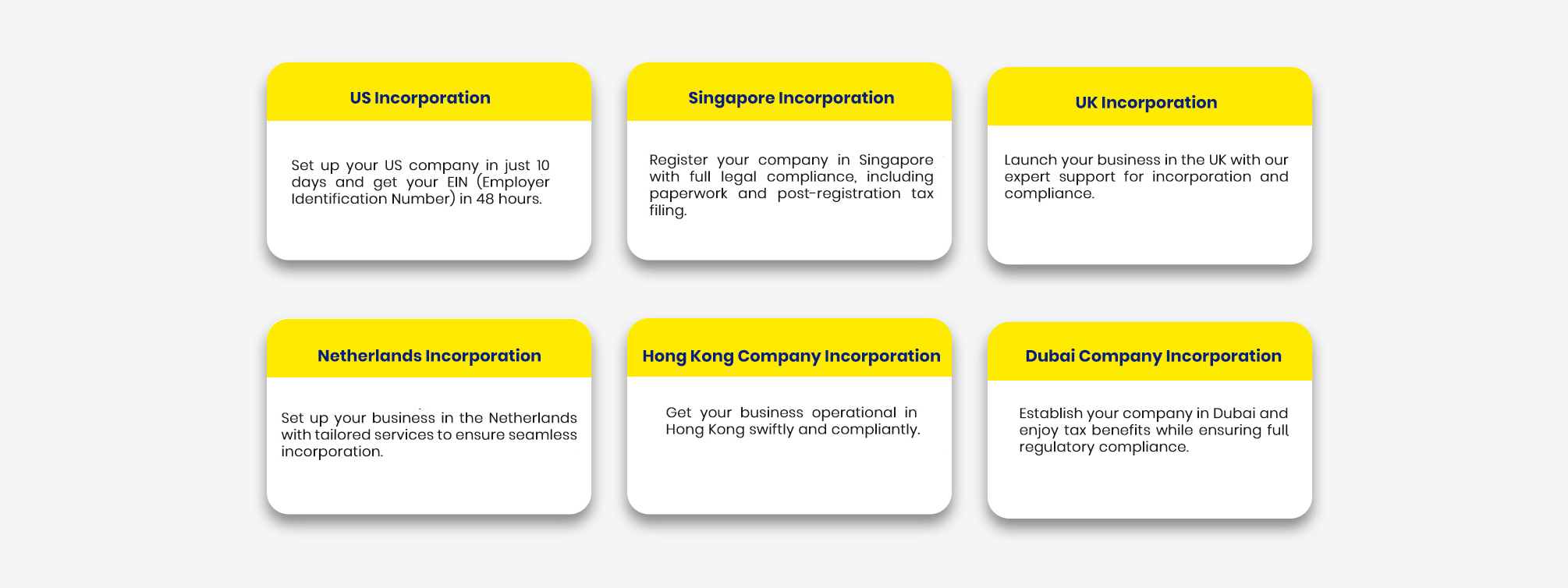

Register Your Business Outside India with GTS

Company Registration in India

Registering your company in India is a critical first step in establishing your business legally and ensuring its successful operation. According to the Companies Act of 2013, any company can be formed for a lawful purpose, provided it follows the principles outlined by the Ministry of Corporate Affairs (MCA). Company registration provides a distinct legal identity, enabling the business to enjoy a range of rights and privileges, including the ability to enter into contracts, sue or be sued, and access government incentives and schemes.

Choosing the right business structure is just as important as the registration process itself. The type of structure you choose impacts everything from liability, governance, taxes, and operational flexibility. A well-chosen structure can help your business meet its goals efficiently and ensure compliance with regulations. Some common types of company structures in India include:

● Private Limited Company: Ideal for startups and businesses looking for limited liability protection and the ability to raise capital.

● Limited Liability Partnership (LLP): Combines flexibility of operations with the benefits of limited liability, suitable for professionals and small businesses.

● One Person Company (OPC): For solo entrepreneurs, offering limited liability and corporate status without the need for multiple partners.

● Sole Proprietorship: Simplest structure with complete control, best suited for small, single-owner businesses.

● Partnership Firm: A flexible and cost-effective structure for businesses with two or more owners sharing profits, liabilities, and responsibilities.

Once your company is registered with the MCA, it gains legal status and can access various government benefits, including loans, grants, and tax incentives. The official MCA portal provides the platform for company registration, allowing businesses to complete all the necessary formalities and acquire a legal identity.

At GTS, we can help you navigate the entire process, from choosing the right structure to completing all the registration steps. Get in touch with us today to register your company seamlessly and start your business on the right path!

Advantages of Registering a Company with GTS

1. Expert Support: Access to experienced professionals such as company secretaries, auditors, and chartered accountants to ensure smooth company incorporation.

2. Complete Documentation Assistance: Help with all necessary documents like DSC, DIN, TAN, and PAN for a hassle-free registration process.

3. Fast Name Registration & MCA Filing: Quick processing of company name registration and filings with the Ministry of Corporate Affairs (MCA).

4. Online & Transparent Process: Track your registration status online with regular updates from a dedicated point of contact.

5. Post-Incorporation Compliance: Ongoing support for annual filings, tax returns, GST, and other compliance requirements, as well as assistance with opening a business bank account.

GTS simplifies the entire company registration process, offering expert guidance, efficient processing, and post-registration compliance support.

Eligibility Criteria for Company Registration in India

As per the Companies Act of 2013, the eligibility requirements for company registration vary based on the type of business entity. However, here is a general outline of the key eligibility criteria:

1. Indian Resident Director: The company must have at least one director who is a resident of India.

2. Digital Signature Certificate (DSC) & Director Identification Number (DIN): All directors must have a valid DSC and DIN.

3. Legality: The company should not engage in any illegal activities as defined by Indian law.

4. Legal Age of Directors and Shareholders: Directors and shareholders must be of legal age (18 years or older).

5. Proof of Address and Identity: Directors must submit address proof and identity proof as part of the registration process.

6. Unique Company Name: The company must have a unique name that is not identical or similar to any existing company or trademark.

These criteria ensure that companies operate in accordance with the law and are properly registered with the Ministry of Corporate Affairs (MCA).

Company Registration Checklist

To register a company in India, follow these steps:

1. Choose Company Type: Decide on the type of company (e.g., Private Limited, LLP).

2. Company Name: Select a unique name for your company.

3. Business Address: Ensure you have a valid registered office address.

4. Director Details: Provide ID and address proof for at least two directors (one must be an Indian resident).

5. Shareholders: Have a minimum of two shareholders.

6. Capital: Decide the required capital for your company.

7. Memorandum of Association (MoA): Draft the company’s objectives.

8. Apply for DSC and DIN: Obtain Digital Signature and Director Identification Number for directors.

9. GST Registration: Register for GST if applicable.

10. Company Bank Account: Open a current account in the company’s name.

11. Professional Appointments: Appoint an auditor, CA, and CS if necessary.

12. Tax Numbers: Obtain TAN and PAN for the company.

13. Intellectual Property: Consider registering trademarks and logos.

Required Documents for Company Registration in India

To successfully register your company in India, you need to provide a set of essential documents for directors, shareholders, and the registered office address. Here’s the list:

1. Passport-sized photos of directors and shareholders.

2. PAN Card of all directors.

3. Proof of identity for directors (Aadhar, Passport, Voter ID, or Driver’s License).

4. Proof of residence for directors (e.g., utility bills, bank statements).

5. NOC (No Objection Certificate) from the property owner of the registered office address.

6. Utility Bills (e.g., electricity or water bills) as proof of the registered office address.

7. Memorandum of Association (MOA): Outlining the company’s objectives.

8. Articles of Association (AOA): Defining the company’s internal rules and regulations.

9. Director and Shareholder Details: Personal and professional details.

10. Digital Signature Certificate (DSC): For directors to sign documents electronically.

11. Director Identification Number (DIN): A unique number for each director.

These documents are crucial for the legal registration and compliance of your company under the Ministry of Corporate Affairs (MCA) in India.

Step-by-Step Company Registration Process

1. Register Your Company Name

Name Approval: Our team assesses your company’s requirements. Based on your needs, we will file the RUN (Reserve Unique Name) form or SPICe-A form for name approval. Once the name is approved, we proceed to file the SPICe-B form for registration.

2. Procure Your DSC (Digital Signature Certificate) and DIN (Director Identification Number)

DSC and DIN: We assist you in obtaining the Digital Signature Certificate (DSC) and Director Identification Number (DIN). These are crucial for conducting online transactions and submitting documents to the Ministry of Corporate Affairs (MCA).

3. File MOA, AOA, PAN, TAN, and Obtain Incorporation Certificate

Filing Documents: We prepare and file the Memorandum of Association (MoA) and Articles of Association (AoA), along with the SPICe+ form, PAN, and TAN applications.

Incorporation Certificate: Once all documents are verified and processed, the MCA will issue your Incorporation Certificate, making your company officially registered.

Types of Company Registration in India

Under the Companies Act of 2013 and other relevant laws, various business entities can be registered in India, each offering different benefits and compliance requirements. Here’s an outline of the main types of business entities and their features:

|

Entity Type |

Private Limited Company |

One Person Company (OPC) |

Limited Liability Partnership (LLP) |

Partnership Firm |

Proprietorship Firm |

|

Compliance Requirement |

Companies Act, 2013 |

Companies Act, 2013 |

Limited Liability Partnership Act, 2008 |

Indian Partnership Act, 1932 |

No specified Act |

|

Registration |

Mandatory |

Mandatory |

Mandatory |

Optional |

No |

|

Number of Owners |

2 – 200 |

Only 1 |

2 – Unlimited |

2 – 50 |

Only 1 |

|

Separate Legal Entity |

Yes |

Yes |

Yes |

No |

No |

|

Liability Protection |

Limited |

Limited |

Limited |

Unlimited |

Unlimited |

|

Statutory Audit |

Mandatory |

Mandatory |

As Applicable |

Not Mandatory |

Not Mandatory |

|

Ownership Transfer |

Yes |

Yes (Restricted) |

Yes |

Yes (Restricted) |

No |

|

Perpetual Existence |

Yes |

Yes |

Yes |

No |

No |

|

Foreign Ownership |

Allowed |

Not Allowed |

Allowed |

Allowed |

Not Allowed |

|

Taxation Liability |

Moderate |

Moderate |

High |

High |

Low |

|

Compliance Requirement |

High |

High |

Moderate |

Low |

Low |

Choosing the Right Business Structure

Selecting the right business structure is essential to maximize the benefits of incorporation. Different business structures come with varying compliance requirements. For example, a sole proprietorship only needs to file an income tax return, while a private limited company must submit both annual returns and income tax returns with the Registrar of Companies (ROC). The structure you choose will depend on factors like the number of owners or partners involved, as well as the initial capital required to start your business. You can register your business as a sole proprietorship, partnership, LLP, OPC, Section 8 company, or a private limited company, depending on your specific needs and goals.

Post-Registration Compliance

Once your company is registered in India, adhering to post-registration compliance is essential to maintain legal and operational standing. The required compliance tasks vary depending on the type of business entity, but there are several key responsibilities that all companies must fulfill:

1. Annual Compliance – This includes filing annual returns, conducting statutory audits, completing ROC filings, and complying with tax audits as per entity-specific regulations.

2. Accounting & Bookkeeping – Maintain accurate financial records, carry out tax planning, ensure GST compliance, and file income tax returns, all while adhering to current accounting standards.

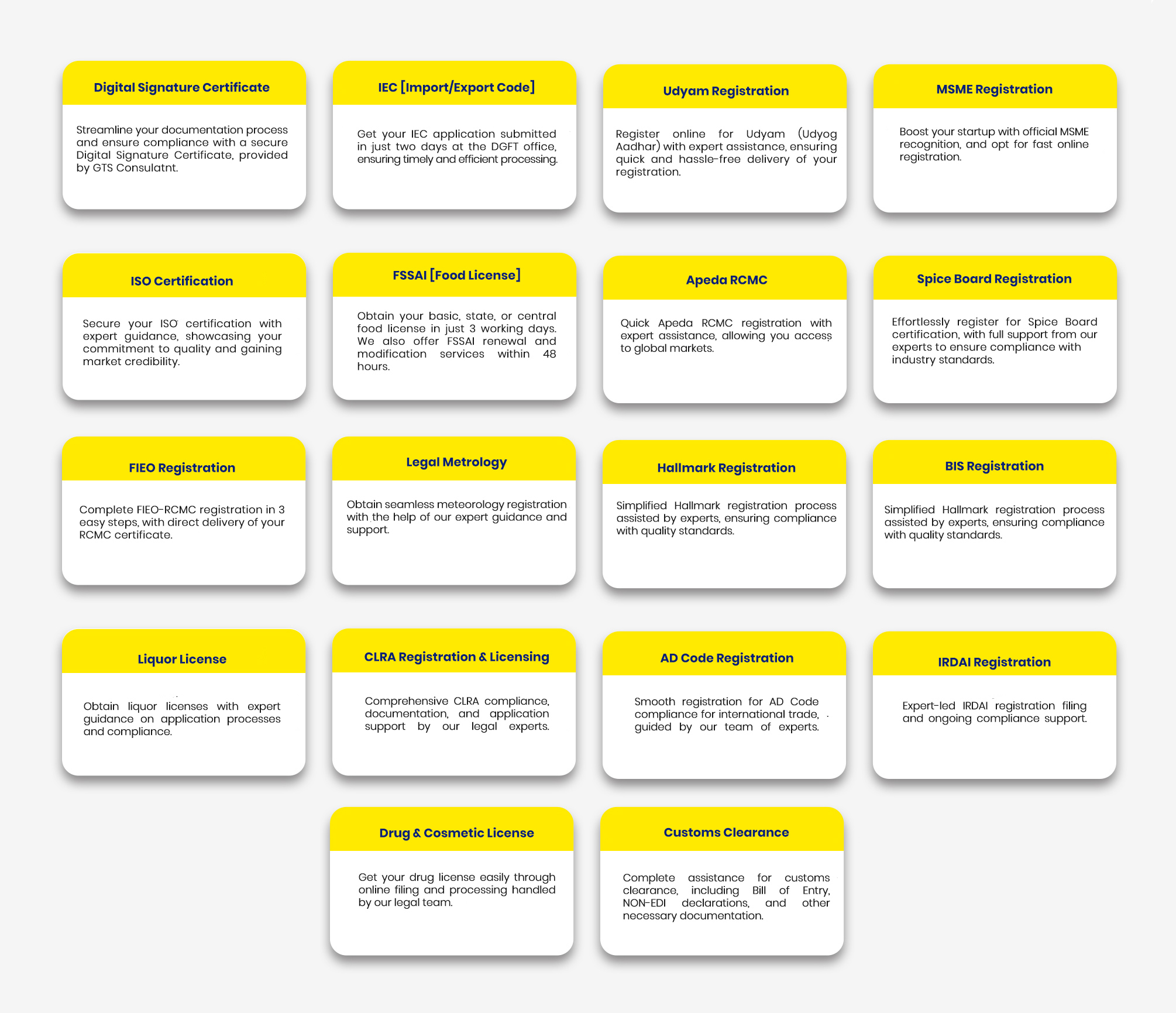

3. Other Registrations – Depending on your business, you may need additional registrations such as MSME, IEC, ISO certifications, FSSAI (food license), Apeda RCMC, liquor licenses, or even firearm licenses.

4. Corporate Secretarial – Compliance with governance, conducting regular meetings, filing regulatory reports, and engaging expert board advisors to ensure all legal requirements are met.

By ensuring these post-registration requirements are fulfilled, your business can operate smoothly and stay compliant with Indian laws.

Secure Your Company Name

1. Reflect Business Activity: The company name must reflect the primary activity of the business, as per legal guidelines.

2. Avoid Prohibited Words: Ensure the name doesn’t include words prohibited under the Names and Emblems Act.

3. Uniqueness: The name should be distinct and not similar or identical to any existing registered company names.

4. Registration via SPICe+ Application: The company name should be registered through the SPICe+ application on the MCA portal. You can apply for up to two names.

5. Approval & Reservation: Once submitted, the ROC will verify and approve the name. The approved name is reserved for 20 days.

6. Filing Form Part B: Within 20 days of approval, you must file the SPICe+ Form Part B. If not filed on time, the application will be rejected, and you will need to start the process over.

Securing your company name is a critical step in the registration process, so make sure to follow the guidelines and deadlines carefully.

How GTS Simplifies the Company Registration Process

Simplify Company Registration with GTS

GTS ensures a hassle-free company registration experience through expert guidance, an easy-to-use platform, and customized solutions. Here’s how we support your business:

1. Personalized Expert Assistance: Our knowledgeable team offers step-by-step guidance, from choosing the appropriate company structure to preparing and filing essential documents.

2. Easy-to-Use Platform: Our intuitive online platform streamlines the registration process, making it straightforward and efficient for all businesses.

3. Clear and Transparent Pricing: We provide upfront pricing without hidden charges, helping businesses plan their registration expenses effectively.

4. Real-Time Updates: Stay informed at every stage of the registration process with timely notifications and progress updates, ensuring deadlines are met.

5. Compliance Support: We handle all legal requirements, ensuring your business is fully compliant and minimizing the risk of errors or delays.

6. Ongoing Assistance: Beyond registration, GTS offers continued support with compliance tasks, such as annual filings, tax returns, and other regulatory obligations.

By combining advanced technology, legal expertise, and exceptional customer service, GTS simplifies the process of company registration. This allows you to focus on growing your business with confidence and peace of mind.

FAQ

Failing to meet post-registration obligations, such as filing annual returns, maintaining accounting records, and holding required meetings, can lead to penalties, legal issues, and even company dissolution. Compliance is essential for ensuring legal and operational integrity.

Yes, a foreign national can be a director in an Indian company, provided they meet specific conditions set by the Companies Act of 2013 and other relevant regulations. They must fulfill the eligibility criteria, which may include obtaining the appropriate visa (e.g., Employment or Business visa) and complying with residency requirements. Additionally, the company must adhere to statutory compliance related to foreign directorship.

A business name is the legal name of a company registered with authorities for official purposes, while a trade name is the brand name used for marketing and business operations. The business name is required for legal documentation, whereas the trade name may or may not be the same and is often used for customer-facing activities.

Company registration brings several tax implications, including:

1. Corporate Income Tax: Companies must pay taxes on profits, with rates varying by size and structure.

2. GST: If turnover exceeds the threshold, GST registration and periodic filings are required.

3. Tax Filings: Companies must file annual returns and comply with other applicable taxes based on their business type.

These obligations depend on the company’s structure and activities, so proper tax planning is crucial to avoid penalties.

To check the availability of a company name, you can:

1. MCA Portal Search: The Ministry of Corporate Affairs (MCA) website offers a tool that enables users to check if a specific company name is already registered by another entity.

2. RUN Service: The Reserve Unique Name (RUN) service on the MCA portal allows users to check and reserve a company name. You can propose up to two names for approval, and if available, the chosen name will be reserved for 20 days.

For company registration, a physical office space is not required, but a registered office address is mandatory for legal and communication purposes. This can be a commercial, residential, or virtual office, as long as it is operational and able to receive official correspondence.

The Companies Act, 2013 specifies that private limited companies must have a minimum of two shareholders, while public limited companies require at least seven shareholders. There is no upper limit on the number of shareholders for either type of company.