EPF Calculator

Struggling with PF and EPF calculations?

Let GTS’s PF Interest Calculator simplify your calculations for you! It helps you easily compute your EPF balance and interest, giving you a clear picture of your retirement savings.

Ready to learn more about PF and EPF? Explore now!

What is EPF?

The Employee Provident Fund (EPF) is a retirement savings scheme specifically designed for salaried employees. It is managed by the Employees Provident Fund Organisation (EPFO), which covers any organization or firm that employs 20 or more employees. The EPF aims to provide financial security and retirement benefits to employees.

The EPFO runs three main schemes:

The EPF Scheme (1952)– Focused on savings for retirement.

The Pension Scheme (1995)– Provides pension benefits post-retirement.

The Insurance Scheme (1976)– Offers life insurance benefits to members.

What is an EPF Calculator?

An EPF Calculator (also known as the PF Maturity Calculator Online) is a tool that helps you estimate the total amount of funds that will accumulate in your Employee Provident Fund (EPF) account by the time of your retirement. It calculates the lump sum you will receive, factoring in both your contributions and those made by your employer, along with the interest that accrues over time.

How Does an EPF Calculator Work?

An EPF Calculator helps you determine the total amount of funds that will accumulate in your Employee Provident Fund (EPF) account by the time of retirement. It uses specific formulas and the information you provide to calculate the lump-sum amount that includes both the employee and employer contributions, as well as the interest that accrues over time.

How to Use the EPF Calculator

To use the PF Maturity Calculator, individuals need to enter the following details:

Age

Monthly Basic Salary

Employee’s Contributionto the EPF

Employer’s Contributionto the EPF

Dearness Allowance (DA)

Existing EPF Balance(if known)

Retirement Age(usually up to 58 years)

After entering this information, the calculator will estimate the total EPF funds available at retirement, considering all contributions and interest accumulated.

How the EPF Calculation Works

The EPF calculation depends on contributions from both the employee and the employer:

Employee’s Contribution:12% of (Basic Salary + DA)

Employer’s Contribution:12% of (Basic Salary + DA)

Note: The employer’s contribution of 12% is divided as follows:

33%goes to the Employee Pension Scheme (EPS).

67%goes to the EPF account.

Understanding Key Terms

|

Term |

Meaning |

|

Basic Pay |

The basic salary before any additional contributions or allowances. |

|

Dearness Allowance (DA) |

The allowance added to the basic pay, often adjusted for inflation. |

EPF Interest Calculation

The PF Interest Calculator helps calculate the interest on both employee and employer contributions. The interest is calculated at the end of each year, based on the applicable interest rate set by the EPFO.

For the financial year 2023-2024, the EPF interest rate is set at 8.15% per annum. This is the rate at which interest will be credited to the Employee Provident Fund (EPF) accounts of employees covered under the Employees’ Provident Fund Organisation (EPFO).

By using the EPF interest calculator, individuals can easily calculate the interest earned monthly and annually on their EPF balance.

How to Use the GTS Consultant EPF Calculator (India)

The GTS Consultant EPF Calculator is a free and easy-to-use online tool designed to help employees estimate how much money they will have saved up for retirement in their Employee Provident Fund (EPF). It also helps employees determine how much they need to contribute in order to reach a specific retirement savings goal.

Steps to Use the GTS EPF Calculator:

To use the calculator, you’ll need to enter some basic details about your salary and savings:

Input Information:

Monthly Salary:Your basic monthly salary, including any dearness allowance (DA).

Current Age:Your current age.

Retirement Age:The age at which you plan to retire (usually 58 years).

Your Contribution to EPF:The percentage of your salary that you contribute to the EPF (usually 12% of your basic salary).

Employer’s Contribution to EPF:The employer’s contribution to the EPF (also 12%, but split between the EPF and pension scheme).

Current Interest Rate:The applicable interest rate for EPF (for FY 2023-2024, it is 15% per annum).

Output Information:

Maturity Amount:The total amount of money you can expect to receive from your EPF account at the time of retirement. This includes both your contributions, your employer’s contributions, and the interest that accrues over the years.

By using the GTS EPF Calculator, you can better understand your EPF balance at retirement and plan your finances accordingly for a more secure future.

Benefits of Using the GTS PF Calculator:

Accurate Results:Provides precise estimates of employee and employer contributions, plus accrued interest.

Quick Results:Simplifies the calculation process and delivers fast results.

Easy to Use:User-friendly and requires no special knowledge to operate.

Retirement Planning:Helps estimate the total EPF amount available at retirement, aiding in financial goal setting.

Comparison Options:Allows comparison of different contribution rates and investment scenarios for better financial planning.

The GTS EPF calculator is a quick, accurate, and simple tool for managing and planning your retirement saving

EPF Contributions Explained

Key Points About EPF Contributions:

1. Employee Contributions:

Employees are required to contribute 12%of their pay (including basic salary, dearness allowance, and retention allowance) to the EPF.

There is no cap on how much an employee can voluntarily contribute above the mandated 12%. Any excess is referred to as Voluntary Provident Fund (VPF), which also earns tax-free interest.

2. Employer Contributions:

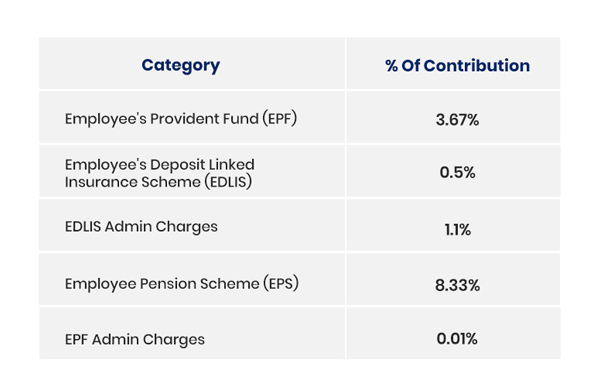

Mandatory Contribution: Employers are required to contribute 12% of the employee’s basic salary, allocated as follows:

8.33% is directed to the Employee Pension Scheme (EPS).

The remaining 3.67% is added to the employee’s EPF account.

VPF Contributions: Employers are not obligated to match any voluntary contributions (VPF) made by the employee.

Additional Contributions: Beyond the 12%, employers also contribute:

0.5% toward the Employee Deposit Linked Insurance (EDLI) scheme.

0.5% (or Rs. 500, whichever is higher) for EPF administrative charges.

0.01% to cover EDLI administrative fees.

These contributions collectively enhance the employee’s financial security and support retirement benefits.

Interest on EPF Contributions:

The EPF interest ratefor FY 2023 is 15% per annum, compounded monthly.

Interest is calculated based on the average monthly balance in the EPF account.

Women Employees:

To encourage women to work in the organized sector, the government reduced the employee’s contributionfor women from 12% to 8% for the first three years, while the employer’s contribution remains at 12%.

EPF Calculator for Easy Calculation:

Using an EPF calculator, individuals can easily estimate their EPF balance based on their contributions and interest rates. The calculator also helps in determining the effect of voluntary contributions and different employer contribution scenarios.

Check Your PF Balance

Here are four quick ways to check your Provident Fund (PF) balance:

1. EPFO Website:

Go to the EPFO website and navigate to the ‘Member Passbook’ section under employees.

Log in using your Universal Account Number (UAN) and password to access your PF passbook.

Here, you can view the opening and closing balances, details of contributions made by both the employee and employer, and any PF interest accrued. If you have multiple PF accounts linked to your UAN, you can select the specific Member ID to view each one.

2. Unified Portal:

Log in to the Unified Portalusing your UAN and password to check your PF balance.

You can also view the PF contributionsfor different financial periods. Additionally, you can use an EPF calculator to calculate contributions and interest.

3. Through SMS:

Send an SMS to 7738299899 with the message: EPFOHO UAN ENG (Replace “ENG” with your preferred language, such as “HIN” for Hindi).

This service sends PF balance details directly to your registered mobile number. You’ll receive an SMS containing your latest PF balance and contribution information based on your KYC details.

4. Through a Missed Call:

Dial 011-22901406 from your registered mobile number to check your PF balance.

After a missed call, you will receive an SMS containing your PF balance and the latest contribution details.

These methods provide easy and convenient ways to stay updated on your PF balance.

EPF Interest Rates (2023 & Past Years)

Here are the EPF interest rates for the past few financial years:

|

Financial Year |

EPF Interest Rate |

|

2022-2023 |

8.15% |

|

2021-2022 |

8.10% |

|

2020-2021 |

8.50% |

|

2019-2020 |

8.50% |

|

2018-2019 |

8.65% |

|

2017-2018 |

8.55% |

|

2016-2017 |

8.65% |

|

2015-2016 |

8.80% |

|

2014-2015 |

8.80% |

|

2013-2014 |

8.80% |

|

2012-2013 |

8.50% |

As you can see, the EPF interest rate has fluctuated over the years, with the highest rates in recent years being 8.80% for 2015-2016, and the current rate for 2022-2023 being 8.15%. This rate change reflects the EPFO’s efforts to balance subscriber interests with economic conditions.

Formula to Calculate EPF Amount

The formula used to calculate the EPF amount is:

EPF amount=(Basic Pay+Dearness Allowance)×(Employee Contribution Rate+Employer Contribution Rate)EPF amount=(Basic Pay+Dearness Allowance)×(Employee Contribution Rate+Employer Contribution Rate)

What an Individual Can Gain with an EPF Calculator

An EPF Interest Calculator offers several key advantages that help individuals effectively manage their retirement savings:

Track Contributions: The calculator enables individuals to track their contributions to their EPF account from both the employee and the employer. This provides a clear picture of how contributions grow over time.

Estimate Retirement Savings: It can estimate the total amount available in the EPF by retirement, allowing individuals to plan for their future and set realistic financial goals.

Compare Investment Strategies: The calculator allows users to compare different EPF interest rates and investment strategies, helping them assess which options are best suited for growing their retirement savings.

Make Informed Decisions: It assists individuals in making informed decisions regarding their EPF contributions, ensuring they are setting aside enough to meet their desired retirement goals.

By using an EPF calculator, individuals gain valuable insights into their retirement savings, enabling them to make strategic decisions for a financially secure future.

FAQ

Both you and your employer are required to contribute 10% or 12% of your basic pay to the EPF. However, female employees are only obligated to contribute 8% of their basic pay for the first 3 years of employment. During this period, the employer’s contribution remains at 12%.

EPF offers several advantages, including the option to make partial withdrawals in specific situations such as:

Medical emergencies

Repayment of housing loans, or the construction/purchase of a new home

Home renovations

Wedding expenses(for self or children)

Yes, the GTS EPF Calculator helps you track and monitor your EPF returns effectively. It provides a clear view of your EPF savings growth over time, allowing you to make informed decisions about your EPF investments. By calculating your potential returns, it enables better financial planning and helps you optimize your EPF contributions for retirement.

GTS’s PF Maturity Calculator offers several key benefits:

Simplified EPF Returns Calculation.

Accurate Retirement Corpus Forecast:

Comparison of EPF Investment Options:

These features make GTS’s PF Maturity Calculator a valuable tool for effective EPF managementand retirement planning.

Yes, the EPF offers a relatively high rate of interest compared to other fixed-income investment options in India. As of September 2021, the EPF interest rate is 8.15% per annum, making it an attractive option for long-term savings. This interest rate helps EPF members grow their retirement corpus effectively over time.