Mutual Fund Returns Calculator

A Mutual Fund Returns Calculator is a useful tool that helps investors estimate the future value of their investments in mutual funds. Whether you’re making monthly SIPs (Systematic Investment Plans) or a lumpsum investment, this calculator can give you an idea of how much your investment could grow over time, based on the expected rate of return.

Mutual Funds - An Overview

An investment vehicle known as a mutual fund pools the money of multiple participants and distributes it across a variety of assets, including stocks, bonds, money market instruments, and other securities. A professional asset management company (AMC) oversees these funds and makes wise investment choices for the investors’ benefit.

How to Use the Mutual Fund Calculator

1. Choose Investment Type: Select whether you’re making a SIP or a lump sum investment.

2. Enter Investment Details:

● For SIP, input your monthly contribution, the duration of the investment, and the expected rate of return.

● For Lump Sum, enter the total investment amount, tenure, and expected returns.

3. Click “Calculate”: After entering your details, click on the “Calculate” button to get the projected maturity value and returns.

4. Review Results: The calculator will provide you with an estimate of how much your mutual fund investment will be worth at maturity based on your inputs.

SIP Investment

The Systematic Investment Plan (SIP) is a popular method of investing in mutual funds where you invest a fixed amount regularly (monthly, quarterly, etc.). The future value (FV) of SIP can be calculated using the following formula:

FV=P×[i(1+i)n−1]×(1+i)

Where:

● FV = Future Value of the SIP investment

● P = Amount invested monthly (the SIP amount)

● i = Monthly rate of return (annual rate of return divided by 12)

● n = Number of months the SIP will be invested

Mutual Fund Calculation

When calculating the returns for mutual fund investments, understanding the formulas helps in getting an estimate of the final corpus. Below are the formulas used for lump sum investments and SIP investments:

Lump Sum Investment Formula:

For a lump sum investment (where you invest a one-time amount), the formula to calculate the maturity amount (M) is:

M=P×(1+100r)n

Where:

● M = Maturity amount (final amount after investment period)

● P = Principal amount (initial investment)

● r = Annual rate of return (expressed as a percentage)

● n = Investment duration in years

2. SIP Investment Formula:

For Systematic Investment Plan (SIP) (where you invest a fixed amount regularly), the formula for the maturity amount (M) is:

M=A×[(1+100i)n−1]×100i1+100i

Where:

● M = Maturity amount (final value of your SIP investment)

● A = SIP contribution per period (monthly SIP amount)

● i = Monthly rate of return (annual rate of return divided by 12)

● n = Number of periods (months)

How Can Mutual Fund Calculator Help

By taking into account variables like investment amount, duration, and estimated rate of return, a mutual fund calculator assists investors in estimating future returns on their investments. It makes complicated computations easier, enabling you to:

1. Calculate returns by contrasting alternative investing scenarios (different rates, tenures, and SIP vs. lump amount).

2. Plan investments: To reach your financial objectives, decide how much to invest and for how long.

3. Track progress: Keep an eye on how your investments are increasing over time.

4. Establish reasonable goals: Match your investing to long-term goals like home ownership or retirement.

5. Assure accuracy: Make wise choices and steer clear of manual calculation errors.

All things considered, it’s a simple, free service that aids investors in organizing, monitoring, and maximizing their mutual fund investments.

Benefits of GTS Mutual Fund Calculator

1. Simplicity: The calculator is intuitive and easy to use, even for beginners. It requires minimal input, and instantly provides you with estimated returns, making it a hassle-free tool for investors.

2. Flexibility: It accommodates both lump-sum investments and SIP (Systematic Investment Plan), allowing you to choose the type of investment strategy that suits your needs.

3. Comparability: The calculator helps you compare potential returns from various mutual funds, empowering you to make well-informed decisions based on different scenarios.

4. Saves Time: Unlike manual calculations, which can be error-prone and time-consuming, the calculator automates the process, saving you time while ensuring precise and accurate results.

5. Planning: By giving you an estimate of your future returns, the tool helps you plan better for long-term financial goals, like retirement, education, or purchasing a home, giving you clearer insight into how much you can expect to accumulate.

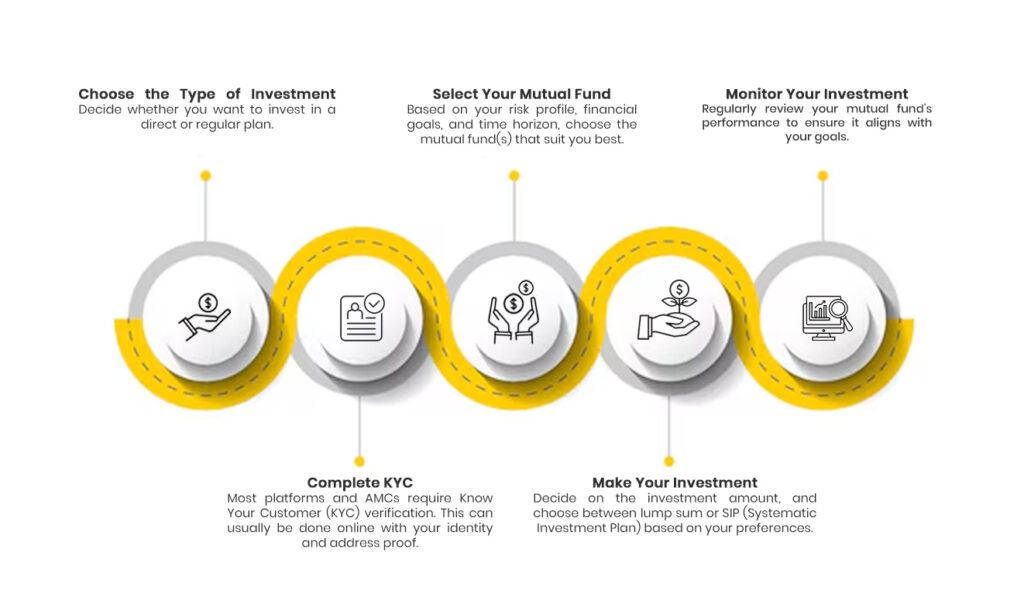

Steps to Invest in Mutual Funds

Types of Mutual Fund Investments

There are two main ways to invest in mutual funds: Systematic Investment Plan (SIP) and Lump Sum. Depending on the investor’s financial status, risk tolerance, and investing objectives, each strategy provides unique benefits.

1. One-time (lump sum) investment: Investing a sizable sum of money in a mutual fund all at once in a single transaction is known as a lump sum.When you have a sizable sum of money to invest all at once, such as from an inheritance, the sale of real estate, or a portion of your accumulated disposable income, this kind of investment is perfect.

2. The second method of disciplined investing is the Systematic Investment Plan (SIP), which involves setting aside a specific amount each month or every three months to invest in a mutual fund scheme of your choosing. Your bank account is automatically debited, and the money is invested in mutual fund units at the current market price.Investors who opt for a long-term investing strategy and want to make smaller, more frequent investments—like using their monthly salary—should consider SIP.

Why Choose GTS’s Mutual Fund Calculator

GTS’s mutual fund calculator offers an easy and accurate way for investors to estimate potential returns on their investments. Here’s why it’s a great tool for mutual fund investors:

● Accurate Projections: The calculator helps provide an estimation of how much your investment could grow based on the given inputs.

● User-Friendly: It’s easy to use for both beginners and experienced investors.

● Transparency: The calculator allows you to plan and make informed decisions based on estimated returns.

● Expert Support: If you have questions or need further assistance, GTS offers expert guidance.

FAQ

The final amount you accumulate from a ₹10,000 monthly SIP over 15 years will depend on the annual return rate of the mutual fund you invest in.

Use these procedures to invest in mutual funds without a Demat account:

1. Visit the Asset Management Company (AMC): Proceed to the AMC branch of the mutual fund of your choice.

2. Finish KYC: Provide self-attested proof of address and identity for KYC validation.

3. Pick the Fund: Choose a mutual fund plan and make a lump sum or systematic investment plan decision.

4. Fill Out Application: Fill out the investment application.

5. Pay: Use a demand draft, internet transfer, or check.

6. Get Confirmation: Following processing, you will receive a confirmation of your contribution.

Since the AMC holds the money directly, no Demat account is required.

To achieve the goal of earning 1 crore in 5 years, a significant investment and a high-risk, high-return strategy are typically required. This might involve investing in high-growth assets such as stocks, mutual funds, or other financial products with higher yield potential.

You can go to the Asset Management Company (AMC) office and finish the KYC (Know Your Customer) procedure to make a direct mutual fund investment. You can choose the mutual fund plan of your choosing and invest straight away, avoiding middlemen, when your KYC has been validated.

The entire amount you will get at the conclusion of your investment term is known as the future value, or FV. For instance, you can figure out the maturity amount if you invest ₹1,000 a month for ten years in a mutual fund using a Systematic Investment Plan (SIP) with an anticipated 8% annual return. By dividing the annual return rate (8%) by 12 months and 100, the monthly return rate (i) would be 0.006667.